FTX: The $32B implosion

I bookmarked 100+ tweets related to FTX...and organized the best ones here.

Thanks for subscribing to SatPost.

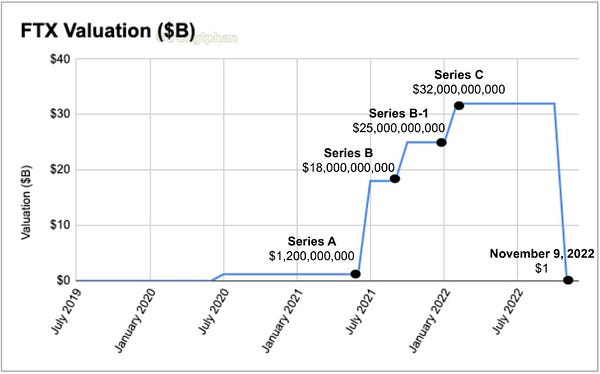

Today, we’re talking about FTX, the crypto exchange that saw its valuation implode from $32B to $0 in a single day. The entire drama unfolded on Twitter and I bookmarked 100+ memes and tweets over the past week (I tried to organize key ones below to give you a full-ish picture of what’s going on).

Let’s get to it.

This issue of SatPost is brought to you by Bearly AI

Do you spend hours reading and writing everyday?

I do (especially this week). Which is why I built Bearly, an AI-powered research assistant that will save you hours of work.

How? The desktop app supercharges your:

Reading (instant summaries)

Writing (auto-generated text)

The best part: it fits right into any workflow.

You hit a keyboard shortcut and get instant access to an AI research assistant that will save you hours of work a week.

FTX’s $32B implosion

It was an insane week for crypto.

Bahama-based crypto exchange FTX saw its valuation plummet from $32B to $0 in one day. It’s founder Sam Bankman-Fried (everyone calls him SBF) saw his net worth evaporate from $16B to $0.

The SBF/FTX implosion is drawing parallels to the infamous energy trading company Enron: a once high-flying firm taken down by criminal financial engineering f**ckery.

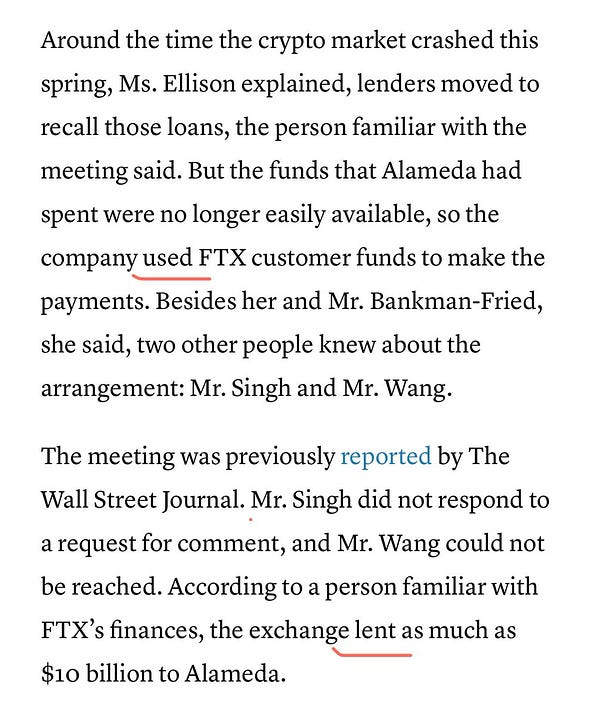

In the case of FTX, the criminal element is the misappropriation of ~$10B of customer deposits (as a teaser of what’s to come, SBF told Reuters that mis-handled funds were due to “confusing internal labeling”).

Meanwhile, people have been live-tweeting the news non-stop (Twitter memes and financial scandals go together like peanut butter and jelly).

The saga is still ongoing but here are key points:

The now 30-year old SBF is an MIT grad who worked at a quant trading firm (Jane Street) before founding a crypto hedge fund / market maker (Alameda Research) and a crypto exchange (FTX) in 2019

The relationship between Alameda Research and FTX has always been opaque (eg. some people believe that Alameda front runs trades based on information it has from the FTX exchange; SBF has denied this but…well, you’ll see)

One of the earliest investors in FTX was Binance, the world’s largest crypto exchange that is run by Changpeng Zhao (everyone calls him CZ). In 2019, CZ invested $100m into FTX for 20% of the firm.

FTX has an underlying token called FTT, which offers certain benefits for users of the FTX crypto exchange but — in reality — has no underlying value outside of what people believe it is worth (like most crypto tokens)

Over the past year, SBF’s profile has risen significantly as FTX raised >$2B from platinum investors and gained a valuation of $32B. SBF’s personal wealth swelled to $16B and he talked up his commitment to effective altruism (he only wanted to make money to “give it away”). SBF also became one of the Democratic party’s biggest donors.

FTX deployed $300m+ on marketing to woo retail investors including stadium naming rights (Miami Heat, which has since dropped FTX), sports partnerships (Steph Curry, Tom Brady) and Super Bowl ads (Larry David). The PR push worked with FTX becoming the 2nd or 3rd largest crypto exchange in the world (FTX also has a US-based firm called FTX US — once valued at ~$8B — which was ostensibly not involved in the financial shenanigans but…well, you’ll see).

CZ sells out of FTX. By the Fall of 2021, FTX had become a serious competitor to Binance and CZ wanted to sell his FTX stake. SBF bought CZ out for $2B+, but part of the deal included CZ receiving a lot of FTT tokens (remember this fact).

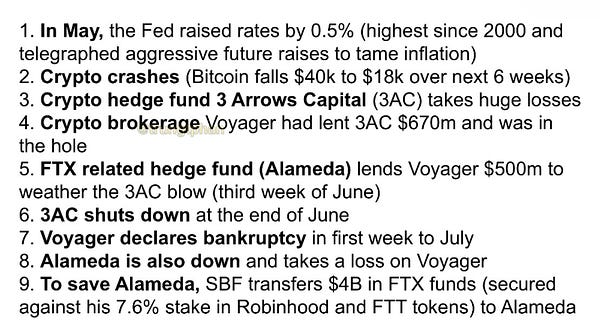

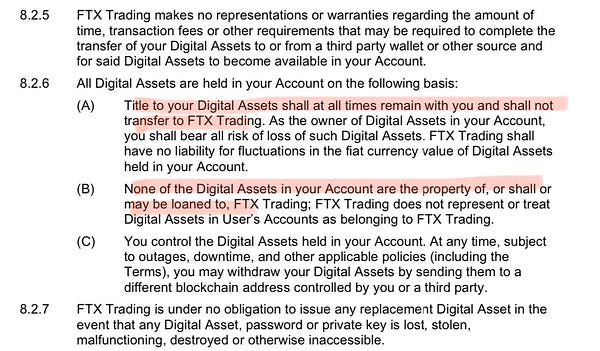

In March 2022, the Fed started raising rates to battle inflation. Speculative assets (*cough* crypto *cough*) started tanking. A number of crypto funds and brokerages blew up. SBF came in as a bailout “savior” (crypto lender BlockFi was saved apparently with the purpose of sweeping in depositor funds into FTX’s scheme). Some compared him to the banker JP Morgan, who propped up the banking industry after a crash in the early 1900s). As we now know, SBF’s hedge fund Alameda Research was also hit hard by the crypto drop…but SBF was able to temporarily hide the problem by “borrowing” (*cough* steal *cough*) customer deposits at FTX (between $5B to $10B) to plug the hole at Alameda. This move is a violation of the terms of service and is the crime.

SBF was the face of the crypto industry’s push for regulation. He appeared before Congress a number of times and lobbied to have clear regulation written (the latest lobbying efforts looked to knee-cap decentralized trading exchanges in favour of centralized exchanges…like FTX)

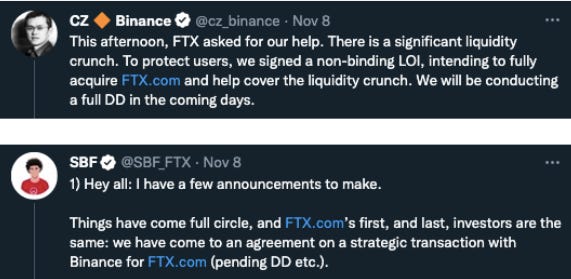

That’s the set-up for what happened last week, which started with this tweet from Binane’s CZ on Sunday:

The “revelations” that came to light was likely a report from Coindesk that nearly half of Alameda Research’s assets were its own FTT tokens (~$6B of ~$15B).

Now, remember how we said the relationship between FTX and Alameda Research was opaque? Well, my friend Jon Wu explains how the game may have been played:

FTX creates FTT token

Alameda buys FTT at a super low price

FTX pumps FTT

Alameda posts FTT back to FTX as collateral, borrowing "real" assets from FTX's customer deposits

Here’s an even simpler explanation:

The “value” of FTT relies entirely on the public’s perception of SBF and FTX (and the sky-high reputation was due to fawning press, famous partnerships and a seemingly strong business).

By early October, there were cracks in the pristine image (as outlined in a Twitter thread): 1) trading volume was down from the crypto crash; 2) competition from decentralized exchanges were rising; 3) top-level executives were resigning; 4) SBF was dabbling in random side projects (even trying to get into Elon’s deal for Twitter); and 5) the market manipulation allegations remained.

Back to CZ. He runs the largest crypto exchange in the world and is the industry’s richest person. If anyone could break faith in a crypto asset, it’s CZ. And that’s exactly what happened when he unloaded his FTT position ($500m+). He may have done it after seeing Alameda’s balance sheet but there are rumours that CZ initiated the FTT sell because SBF talked sh*t about CZ to US regulators.

Either way, SBF tried to calm the market after CZ dumped the FTT. A few of his claims — “FTX is fine. Assets are fine.” and “FTX has enough to cover all client holdings” — were later deleted (but the internet never forgets…and these will almost certainly end up in court).

SBF’s public pronouncements broke the famous dictum by British economist Walter Bagehot that once you have to convince depositors that their money is safe…they won’t believe you and will withdraw funds (that could kick off a bank run).

Between Sunday and Monday, FTX customers withdrew $6B — a much higher rate than usual. FTX soon throttled withdrawals and, by Tuesday, SBF and CZ tweeted out an announcement that Binance was acquiring FTX.

Meanwhile, thousands of users were tweeting and meme-ing the situation. It was surreal to watch.

On Wednesday, Binance walked away from the deal and SBF told investors that he needed $8B to make customers whole (clearly, FTX had commingled user deposits with the hedge fund).

Scrolling through Crypto Twitter, it’s clear that this is the worst few days in crypto history. Worse than every ridiculous scam and implosion before hand.

Why? There’s the broad crypto sell-off in BTC, ETH and every other asset, with concern for even more sell pressure for those exposed to FTX (eg. BlockFi paused customer withdrawals). Then there is the downfall of SBF, who was backed by so many platinum names and was positioned to mainstream crypto. Instead, he burned billions in customer deposits and destroyed faith in the industry. Confidence in crypto from retail — and the huge institutional money — is set back for 5-10yrs. And regulators will be clamping down hard.

All for a bit more return on his hedge fund.

And the scheme was very much not a “mislabeling” of funds. Per a Reuters report, SBF implemented a “back door” which foiled auditors:

In a subsequent examination, FTX legal and finance teams also learned that Bankman-Fried implemented what the two people described as a "backdoor" in FTX's book-keeping system, which was built using bespoke software.

They said the "backdoor" allowed Bankman-Fried to execute commands that could alter the company's financial records without alerting other people, including external auditors. This set-up meant that the movement of the $10 billion in funds to Alameda did not trigger internal compliance or accounting red flags at FTX, they said.

Cobie — a legendary crypto trader widely followed by the industry for his hilarious and no-BS takes — said FTX’s meltdown was worse than the Mt. Gox crypto exchange hack in 2014 (at the time, Mt. Gox was handing 70% of Bitcoin trades).

“When Gox happened, it sorta made sense. Everything was pretty new, when the rumours began it was very plausible.

Every exchange that rugged in the past felt kinda unsafe to use pre-rug.

I thought there was prob sub 1% chance of FTX insolvency.

The rumours for [the FTX blowup] seem so egregious and unnecessary to me. I can’t imagine running an exchange that does mid 8 fig PER DAY in revenue and thinking “how can we leverage this for more?”. I can’t imagine risking a 40+bn business to try & get a multiple on client deposits.

The biggest exchange rugs of the past were incompetence or tech bugs. This one just seems to be…… just stealing customer deposits? Seems completely insane to me, but I guess now I am calibrated better on the extents ppl will go for greed. Cheers Sam.“

Etheruem founder Vitalik Buterin shared a similar sentiment:

On Thursday, SBF wrote an apology on Twitter (the thread hints at the co-mingling of customer funds but leaves a lot of questions unanswered). Then the next day he said that FTX, FTX US and Alameda Research — and 130+ related entities — were filing for bankruptcy (another thread).

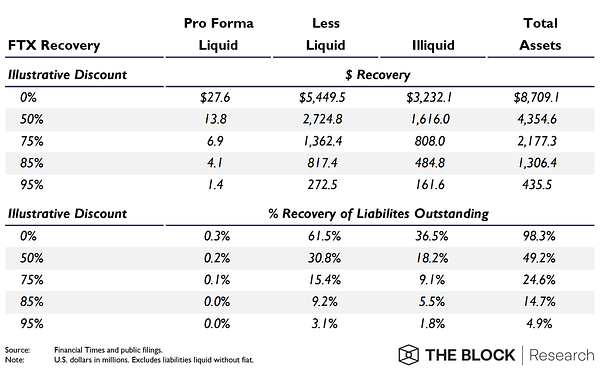

Per CNBC, the bankrupt filing says that there are 100k+ creditors with “assets in the range of $10 billion to $50 billion, as well as liabilities in the range of $10 billion to $50 billion.” But a Financial Times analysis shows that FTX has $9B in liabilities against less than $900m in liquid cash…and the largest liquid position was a “$470mn of Robinhood shares owned by a Bankman-Fried vehicle not listed in Friday’s bankruptcy filing.” (If you’re wondering where the missing money is, a lot was invested in illiquid tokens and venture bets)

Hopefully, smaller investors will be prioritized in the bankruptcy proceedings but — as I write this email at 8am PT on Saturday — there’s been another absurd development: over $600m+ in customer deposits went missing from FTX accounts.

It was initially flagged as a hack. Then FTX’s general counsel said he’d look into out. Then the funds were flagged as hacked. Then the crypto community tracked the funds movements. Then the FTX general counsel said the fund movements were part of the bankruptcy proceedings. At the moment, it looks like $450m was stolen with $200m “saved” by a white hat hacker (follow this thread for the latest updates).

It’s been an insane week for crypto but the insanity doesn’t look like it will end anytime soon.

UPDATE (8pm EST on November 12):

UPDATE (11pm EST on November 14)

The New York Times spoke with key FTX players include SBF and Alameda CEO Caroline Ellison. They admit to misappropriating FTX user deposits to pay back loans they had taken out to make crypto venture investments.

Alameda needed to pay back those loan because it borrowed against its “assets”, which were really just inflated shitcoins (which FTX mostly controlled, including FTT). Here is a very thorough thread:

If you’re not a subscriber, toss your email here for more glorious business and tech takes every Saturday:

Links and Memes

So many FTX tweets and links:

What happens in bankruptcy? By filing for Chapter 11 bankruptcy, SBF could conceivably re-organize the business as a going-concern and pay back depositors that way. FTX’s former head of institutional sales floated such a plan that includes a new token. But since it looks exceedingly like a criminal terms of service violation, courts will have to sort through the 130+ FTX entities and try to scrape out value.

FTX’s newly appointed CEO John Jay Ray III is the same person that led Enron through its bankruptcy proceedings. Unfortunately, early analysis suggests creditors may only get $0.05 on the dollar:

SBF’s inner circle: Based on very early evidence, it sounds like only an inner circle — less than 10 of the 200+ FTX employees — probably knew of SBF’s scheme. They were running like a $100B+ in crypto trading volume with 3 people living in a Bahamas house (with a major assist from stimulants provided by an on-site psychiatrist). Here is a must-read from CoinDesk: Bankman-Fried’s Cabal of Roommates in the Bahamas Ran His Crypto Empire – and Dated. Other Employees Have Lots of Questions.

Meet Caroline Ellison: The mid-20s CEO of Alameda Research. She graduated from Stanford in 2016 with a BsC in Math then worked at Jane Street (the quant hedge fund where SBF also worked). In this wild clip, she explains how little math and risk management the day-to-day job entails.

She also tweeted this once:

SBF’s web of connections: A wild thread from @JagoeCapital highlighting all of the personal relationships SBF (and the FTX team) have to American academia, high finance, politics and regulatory institutions…some highlights:

SBF’s dad is a Stanford law professor with research interest in “decentralized economy”

SBF’s mom is also a Stanford law professor who runs a large Democratic political fundraising organization (in a notable coincidence, SBF launched FTX within two weeks of Biden announcing his presidential run)

Caroline’s dad is Department head of economics at MIT. You know who else was an Economics professor at MIT? The current chair of the Securities Exchange Commission (SEC) — Gary Gensler.

FTX’s General Counsel Ryne Miller was a former regulatory attorney working for … Gary Gensler.

At a minimum, these close ties are eye-brow raising. But when you consider the fact that SBF has given $40m to the Dems and said he wanted to spend $1B on the 2024 election…it’s something to definitely keep an eye on.

Want really technical breakdowns of FTX’s collapse? Read Byrne Hobart’s piece or Matt Levine’ series (here, here, here).

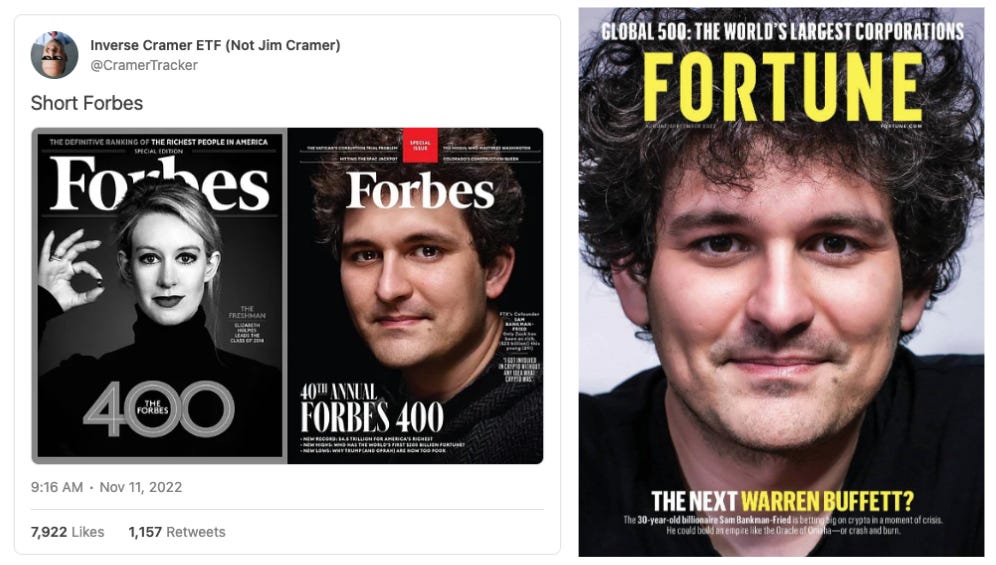

The media: SBF’s meteoric rise was driven in part by fawning coverage (I’ll admit that I found the scruffy MIT math whiz billionaire genius compelling and tweeted about him sleeping on a bean bag chair). Two quick lessons: the Forbes 400 cover is the financial equivalent of the Madden video game curse (players on the cover of Madden regularly have down years or get injured afterwards). The other “Finance Madden curse” is naming someone the “Next Warren Buffett”.

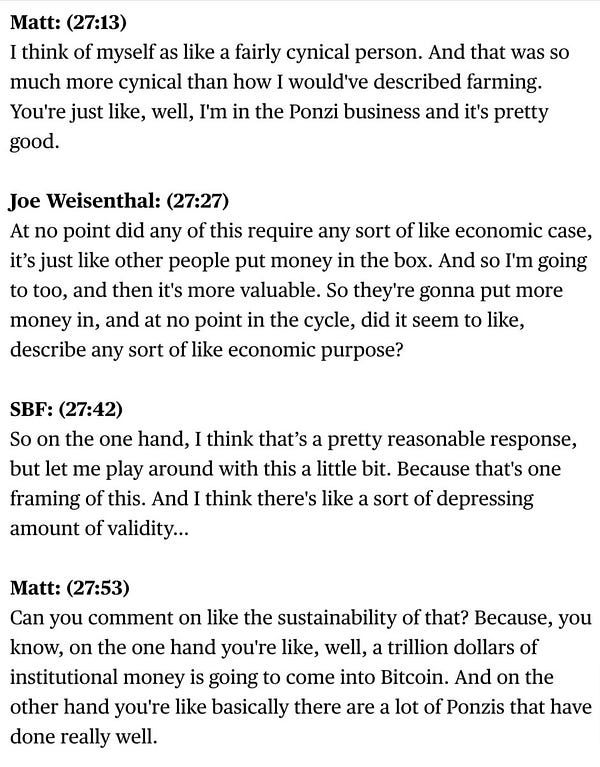

SBF admits he is in the Ponzi business: In April 2022, SBF famously went on the Odd Lots podcast and spoke with the Michael Jordan of finance writing (Matt Levine)…and basically admitted he was in the ponzi business (at the 23-minute mark…here’s transcript).

Other CZ stuff: The Binance CEO — who critics charge is also involved in shady activity — wrote in an internal email that he didn’t have a “master plan” to take down FTX (although, if he did, it would look pretty much identical to what happened). He also said of SBF: “Two big lessons: 1: Never use a token you created as collateral. 2: Don’t borrow if you run a crypto business. Don't use capital "efficiently…Have a large reserve.” … he also dropped this post-mortem:

A plausible conspiracy (?): The SBF/FTX saga has been so absurd that there’s a running joke that SBF was a plant by the US intelligence agency. Will Manidis — CEO of Science.io — has an interesting thread. The part that most resonates with me is the part about SBF’s supposed origin. The FTX founder claims to have built his initial fortune from exploiting a Bitcoin arbitrage trade between Japan and the US:

Crypto Super Bowl ads: In the year 2000, 11 dotcom startups bought ads in the Super Bowl. Within 2-3 years, 8 of the 11 companies had gone bankrupt or been acquired. This year, a number of crypto firms — including FTX, Coinbase, Crypto.com — splurged on ads. It’s been…all downhill since. And the $30m that FTX spent on a Larry David ad is the peak of comedy in hindsight (including a line where he says about FTX “nah, not for me”).

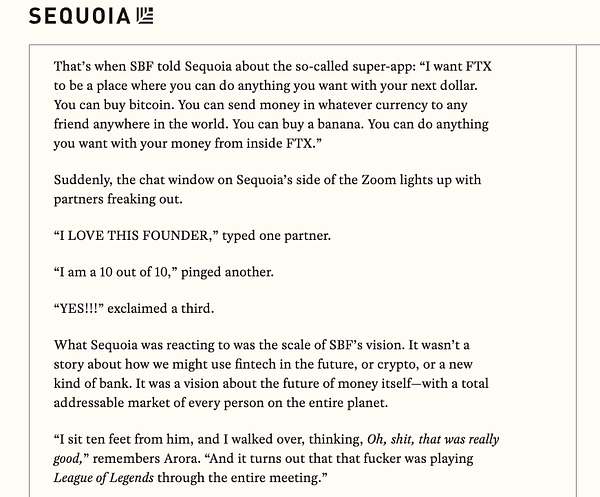

Sequoia Capital — one of the top VC firms — invested big into FTX and wrote a glowing article that bordered on parody. Here’s an excerpt where Sequoia partners were blown away by SBF’s pitch that FTX could become an everyday wallet that “you can [use to] buy a banana” and that the entrepreneur would be a “future trillionaire.”

Its impossible to write comedies with this good of a script SBF pitches the sequoia partnership Vision? "Buy a banana with fake internet money" Blows the partnership away. Wow. During the partner meeting ? PLAY LEAGUE OF LEGENDS This is god-tier comedy

Its impossible to write comedies with this good of a script SBF pitches the sequoia partnership Vision? "Buy a banana with fake internet money" Blows the partnership away. Wow. During the partner meeting ? PLAY LEAGUE OF LEGENDS This is god-tier comedy

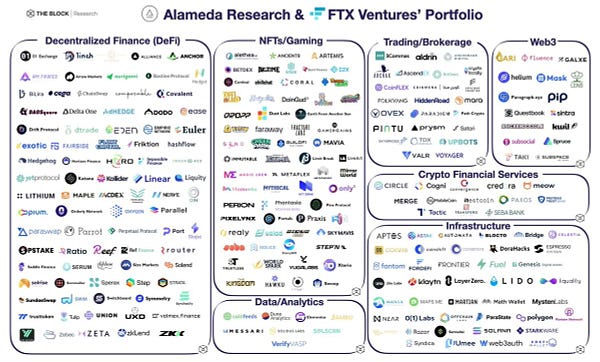

FTX itself was a big investor in other crypto companies and this venture portfolio — which have a paper value ~$8B — will be liquidated to make creditors whole)

The biggest Schadenfreude: During SBF’s rise to the top of crypto, one of his most noteworthy Twitter moments was when he got into an argument with a trader named @Coinmamba over the value of a crypto asset called Solana (SOL). The conversation — which happened in January 2021 — ended with SBF telling @Coinmamba: “I'll buy as much SOL has you have, right now, at $3. Sell me all you want. Then go fuck off.” On Friday, @Coinmamba replied to that thread by writing the exact same phrase and adding a photo of SBF’s net worth being $0.

Ontario Teacher’s Pension Plan (OTTP): Canada has a conservative investing reputation that extends to its massive pension funds. The OTTP manages $240B+ for — you guessed it — Ontario teachers. OTTP basically co-lead on FTX’s past two funding rounds.

The craziest part of the OTTP’s investment: Ontario deemed FTX too risky and it couldn’t even operate in the province. While FTX is a sliver of OTPP's $240B fund, it is still a total embarrassment (Here’s a full list of investors…all will get zero’d on FTX but still happily collect management fees #NoOneKnowsAnything).

Where were the regulators? Matt Stoller writes about why SEC Chair Gary Gensler has been unable to rein in crypto: 1) there hasn’t been an established crypto law so the industry operates in a grey area; 2) multiple regulatory agencies want authority (SEC wants crypto to be securities, CTFC wants crypto to be commodities, Fed/Treasury want jurisdiction over stablecoins); and 3) a lot of crypto-lobbying is going on (as evidenced by the millions that SBF was spending).

Critics of Gensler can point to his various relationships to FTX. Also, his big “win” was slapping Kim Kardashian with a ~$1m fine for pumping crypto while billion-dollar blow-ups keep happening (although the biggest ones — FTX, Terra Luna — are happening overseas).

In a video addressing FTX, SEC commissioner Hester Peirce made two key points: 1) the SEC has failed to create an adequate regulatory framework and needs to work with the industry; and 2) the current SEC approach of “enforcement after the crime” is too slow and reactive (vs. creating a clear framework that could prevent future crimes).Where were the auditors? hahahahaaha

Reaction from other crypto exchanges: Coinbase CEO Brian Armstrong re-affirmed that it operates under US regulations (unlike FTX’s off-shore business) and that customer deposits are held dollar-for-dollar (eg. not loaned out or invested). Meanwhile, Kraken CEO wrote about the future of the crypto industry and why FTX/SBF was such a big blow…he mentions how many SBF red flags there were:

Effective Altruism (EA): SBF wrapped his money-making motivation around the idea of Effective Altruism. He once said that if he could make as much money trading Orange Juice futures, he would (AKA he didn’t care about crypto itself). Those involved with SBF’s EA projects resigned en masse (as its not clear where the funds came from). Vitalik Buterin says “It's not a good look for EA or for ted talk do-gooderism, which SBF also leaned into heavily.”

And here is William MacAskill, a philosopher and one of the leading thinkers behind EA:

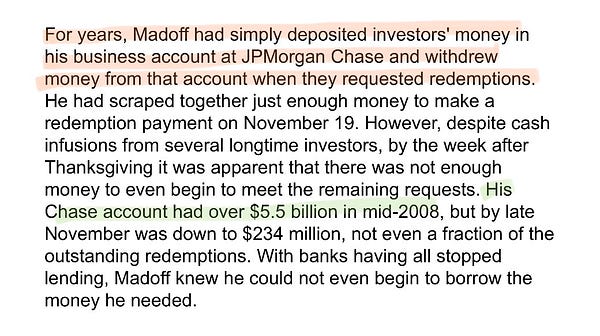

Bernie Madoff parallel? When it comes to defrauding investors, nothing compares to Madoff. Two worthwhile things to flag: 1) the government has been able to claw back $14.5B of the $18B stolen Madoff funds: and 2) Madoff’s scheme was comically unsophisticated:

Decentralized Finance (DeFi): What is DeFi? It’s a part of the crypto industry that settles financial transactions with no intermediaries (eg. brokerage, exchange or bank). The major crypto blow-ups in 2022 are most *centralized* financial institutions like FTX. The appeal of DeFi is that “code is law”. If you put in the code that user deposits can’t be intermingled with a hedge fund…then there’s no intermingling (as in no human intervention can override it). Many in DeFi viewed SBF’s Washington lobbying as a way to snuff out the DeFi industry and — to them — his downfall is good.

Former Coinbase CTO Balaji Srinivasan explains here why a truly decentralized financial system could instil financial discipline and prevent future regulatory capture:

SBF tried to get in on Elon’s Twitter deal: In the leaked Elon texts, SBF was apparently floating a $3-5B investment in Twitter. Elon wasn’t very interested in the offer, saying “I don’t have to have a laborious blockchain debate” and, yesterday, said “[SBF] set off my bs detector, which is why I did not think he had $3B.” … below is Elon a Twitter Spaces chat on Friday night telling his SBF story:

Some wild tweets:

This next one is for real btw:

Part of SBF’s “do-gooder” image was a vocal stance on veganism….

Charlie Munger was right…

One of the biggest problems on Twitter are fake profiles of CZ (Binance CEO) replying to notable accounts with crypto scams. With that context, the following tweet from Barstool CEO Dave Portnoy is extremely funny:

On the day that CZ/SBF announced a potential deal, the UpOnly podcast (hosted by Cobie and Ledger) did a livestream that included Martin Shkreli and Terra/Luna founder Do Kwon…it was bonkers:

Peak FTX was probably when it held a conference in Bahamas and FTX hosted a bunch of really influential people (eg. Bill Clinton and Tony Blair) … while wearing a “19-year freshman I eat ramen 3x a day” outfit:

Axios reported that legendary author Michael Lewis (The Big Short) has been following SBF around for a potential book…which will obviously be amazing and hopefully lead to a much-needed sequel film…

…and we have the perfect actor to play SBF:

And a lead for Caroline?

What an absolutely wild story, and in the middle of a wild week where enough has happened for most normal full years. Thanks for the great overview! 💚 🥃

Such great work. Love the story and your writing style!